how much state tax is deducted from the paycheck

In North Carolina The state income tax in North Carolina is 525. The amount of income tax your employer withholds from your regular pay depends on two things.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

The amount you earn.

. In 2023 maximum taxable earnings will increase to. How Is Tax Deducted From Salary. Use this tool to.

247 on median income of 59393. 249 on median income of 77378. Estimate your federal income tax withholding.

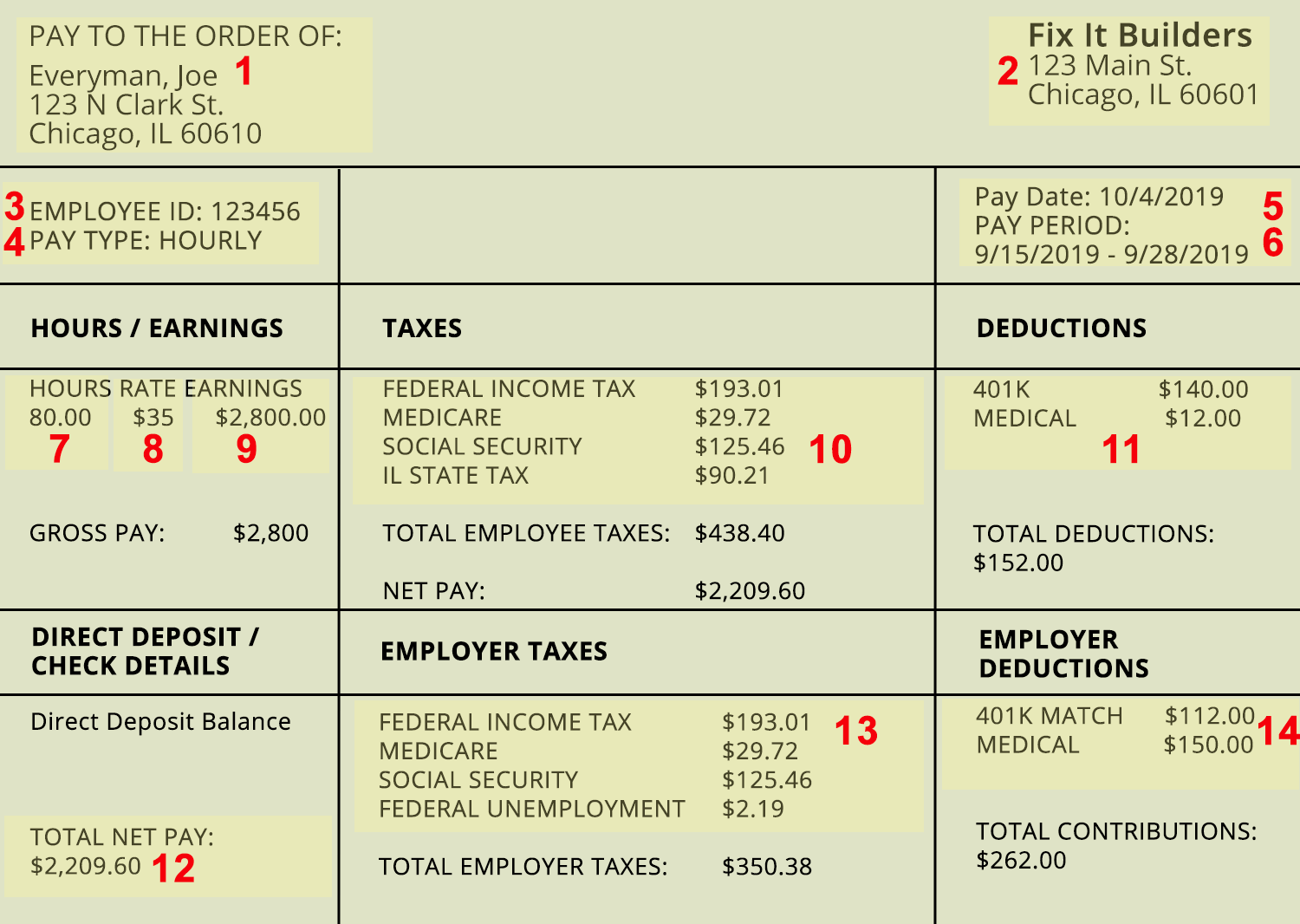

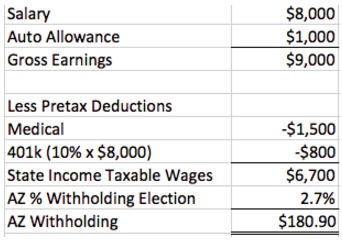

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. With it the worker is deducted 62 of their gross paycheck.

It is a flat rate that is unchanged. How Your Paycheck Works. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

The payer has to deduct an amount of tax based on the rules. So under the normal circumstances IRS taxes forgiven debt as taxable income. Divide the sum of all assessed taxes by the employees gross pay to.

See how your refund take-home pay or tax due are affected by withholding amount. Income Tax Calculator California. Federal income tax and FICA tax.

That means that your net pay will be 9115 per. In October 2020 the IRS released the tax brackets for 2021. The deduction for state and local taxes is no longer unlimited.

252 on median income of 81868. FICA taxes consist of Social Security and Medicare taxes. That includes overtime bonuses commissions.

The mentioned tax has a limit of 147000 earned in the year. If you make 10000 a year living in the region of California USA you will be taxed 885. Therefore it will deduct only the state income tax from your paycheck.

That is to say when workers have earned such an. 2 days agoHigher wages may prompt workers to contribute more payroll taxes into the program which may help offset that. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages.

Your employer pays an additional 145 the employer part of the Medicare tax. However due the American Rescue Plan of 2021 student debt forgiveness will not be taxed. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000.

These amounts are paid by both employees and employers. State Route 19 Berlin Center OH 44401 The Wilmot Township Treasurers Office is located at. For example in the tax.

Main Street Berlin Center OH. For 2022 employees will pay 62 in Social Security. Jan 12 2021 the tax rate is 6 of the.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. The Municipal Office is located at. The information you give your employer on Form W-4 and DE 4.

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

What Are Pay Stub Deduction Codes Form Pros

How To Read A Pay Stub Understanding Your Pay Stub Oppu

How Are Payroll Taxes Calculated State Income Taxes Workest

Decoding Your Paystub In 2022 Entertainment Partners

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Take Home Pay Calculator

State Income Tax Rates And Brackets 2021 Tax Foundation

How To Read Your Pay Stub Paycheckcity

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

How To Calculate Taxes Using A Paycheck Stub The Motley Fool